- Home

- About Us

- Services

UI/UX

- Technology

- Industries

- Blog

Does your financial software need to be updated and more cohesive? Then, find the best full-stack financial software development with appdevguru.

It can be challenging to manage finances, especially with technology ever-evolving. There needs to be more integration and flexibility in traditional financial software systems that hinder them from keeping up with modern demands. Appdevguru can help you with that.

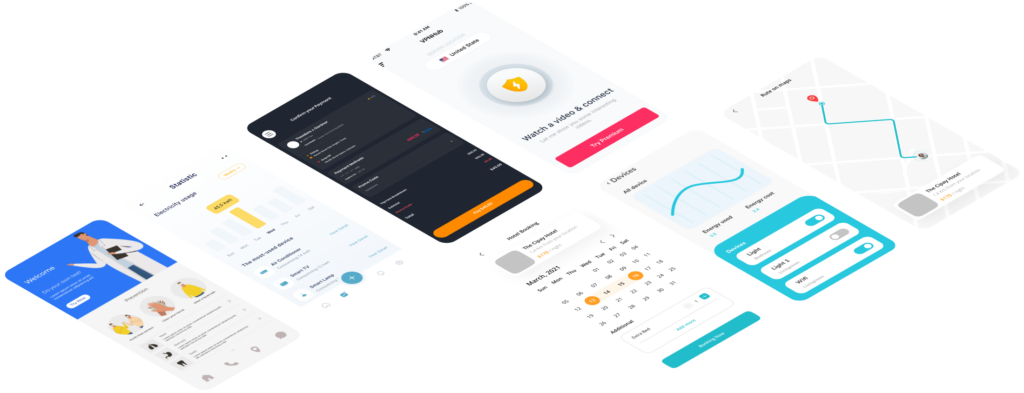

Appdevguru offers a comprehensive solution that covers all aspects of financial management, from accounting to payment processing. With an all-in-one software system, multiple software solutions are eliminated, and seamless integration is guaranteed.

Appdevguru creates customized solutions that meet the needs of each client. Working closely with their clients, they create software systems that streamline their financial operations and maximize efficiency.

Get rid of outdated financial management software and welcome the future with Full-Stack financial software development at appdevguru.

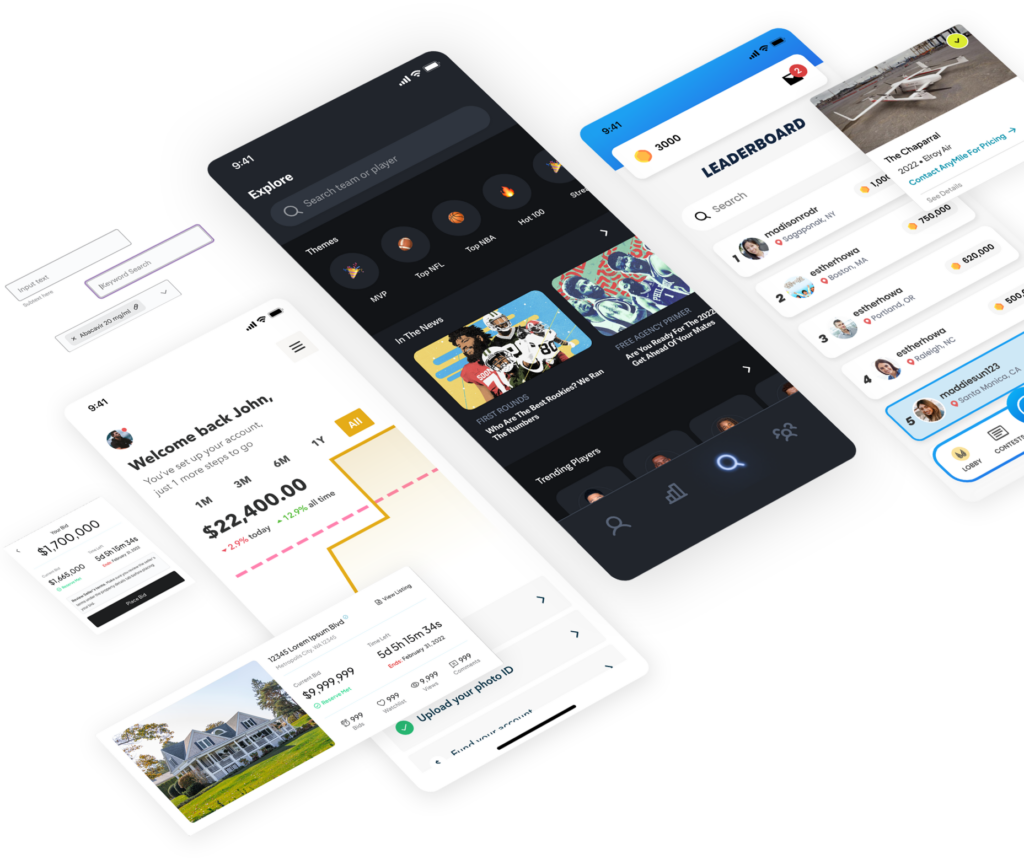

Advanced technologies are essential to gaining a competitive edge in the financial industry. A business that fails to keep up with technological advances in today’s digital era risks losing customers to its competitors. There is no difference between software for the financial industry and any other software. Therefore, software development by financial institutions needs to leverage advanced technologies to remain competitive.

Following is a list of some of the advanced technologies used in financial industry software:

Cybersecurity: Financial institutions are concerned about cybersecurity. Financial institutions need to protect sensitive customer data and transactions from cyber attacks. Biometrics, multifactor authentication, and encryption technologies are improving cybersecurity.

An organization’s decision to hire a financial software development partner is crucial. Unfortunately, the number of providers available can make it difficult to determine which to choose. However, our financial software development services can help your business improve its financial management processes and streamline operations. Listed below are ten reasons you should hire Appdevguru for your financial software development project.

we believe in providing comprehensive solutions that complement your digital transformation in more than one way.

Copyright © 2024, Itworkhub.com. All rights reserved.